“Stay Alive ‘til ‘25”

These were the words that ended last quarter’s Market Update, and as the real estate market comes to terms with the corrosive effects of dramatically higher interest rates and a potentially slowing economy, real estate economists are pushing out the expected recovery date for the industry.

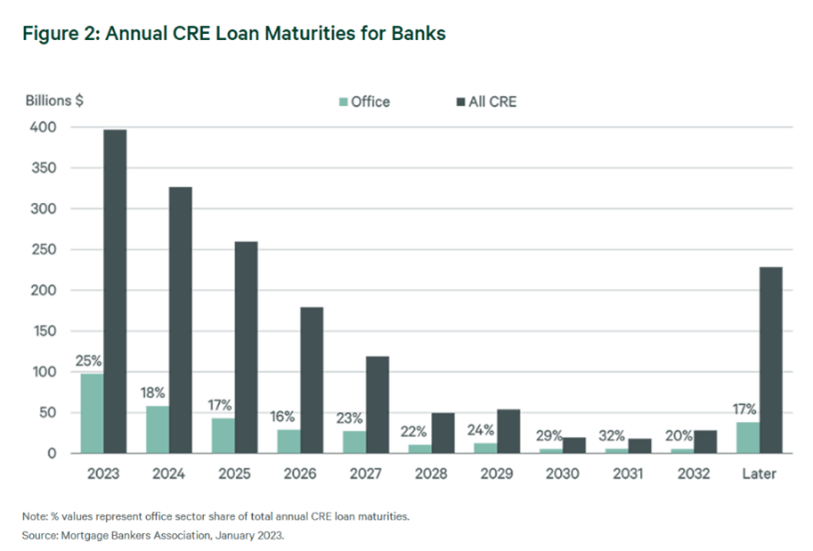

“Our analysis suggests lenders could face CRE loan losses across all property types of up to $125 billion. Almost half of these losses would be concentrated in the banking sector, with office loans accounting for approximately $26 billion. Losses will be greatest in 2023 and 2024, then ease as broader market and financial conditions improve.” (CBRE Intelligent Investment, July 13, 2023)

As you can see from the accompanying chart of bank loan maturities in 2023 and 2024, many of these losses will be realized over the next two years. These typically represent loans where the property is worth less than the outstanding loan amount and lenders are determining the best way to move these loans off their balance sheets.  As such, we are facing an environment of foreclosures and loan workouts and likely will be for quite a while. The process of recognizing lower values and reworking capital structures depends upon ample liquidity in the debt and equity markets. However, banks and other lenders have moved to the sidelines waiting for a bottom in real estate values to come into view. There is plenty of equity capital in opportunistic real estate funds sitting on the sidelines waiting for the same clarity. Recovery will only take place when both capital sources get back on the field and we are not there yet.

As such, we are facing an environment of foreclosures and loan workouts and likely will be for quite a while. The process of recognizing lower values and reworking capital structures depends upon ample liquidity in the debt and equity markets. However, banks and other lenders have moved to the sidelines waiting for a bottom in real estate values to come into view. There is plenty of equity capital in opportunistic real estate funds sitting on the sidelines waiting for the same clarity. Recovery will only take place when both capital sources get back on the field and we are not there yet.

“First-quarter sales volume dropped 70% year-over-year across all four of the core sectors – Office, Industrial, Apartments and Retail – as property values continue to erode…The bottom line is that CRE volume is likely to stay depressed in the near-term as long as debt activity is subdued,” (Green Street, July 11, 2023)

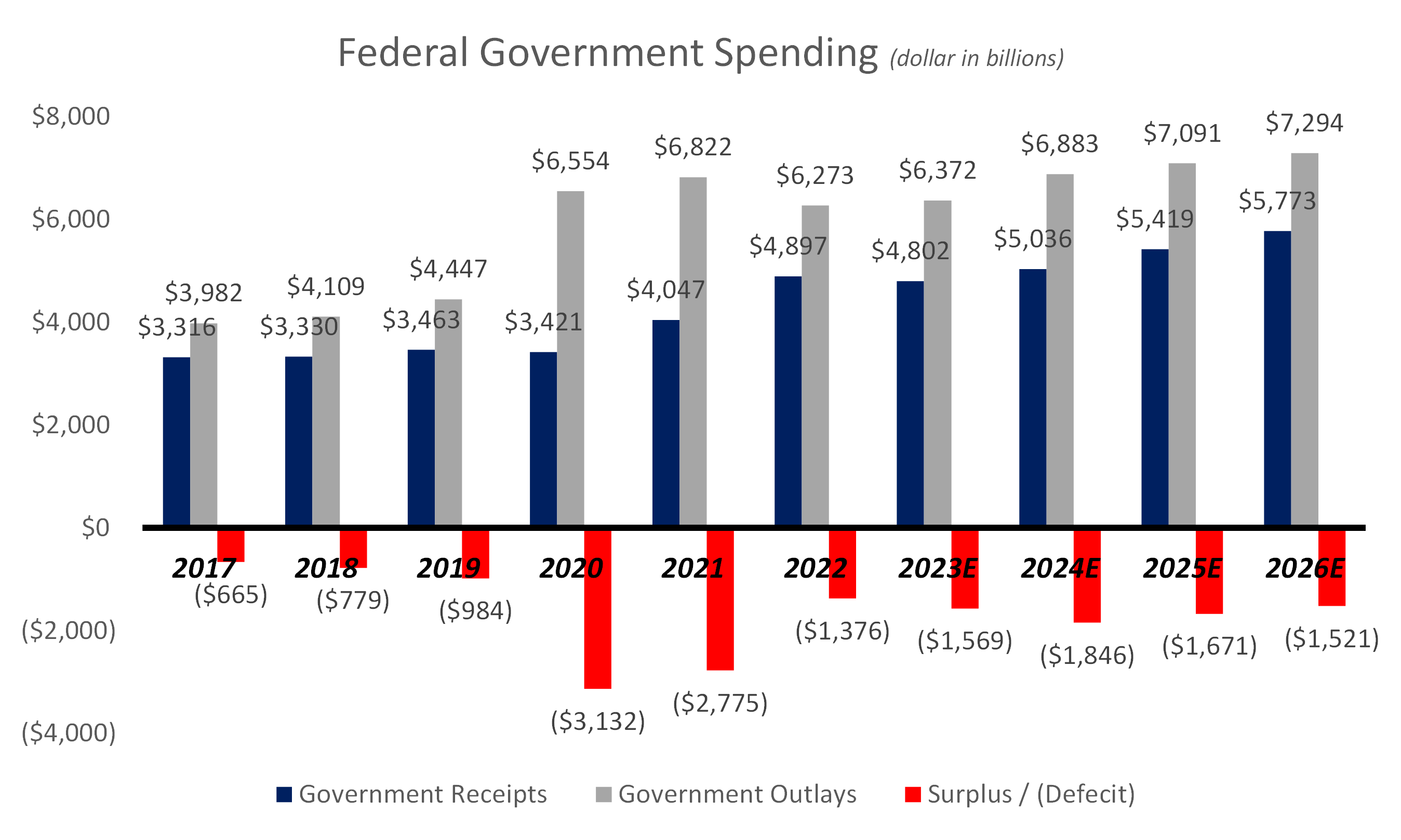

As price discovery and liquidity in the real estate markets evolve over the coming months and years, the performance of the economy and the course of interest rates will both play a significant role in any real estate recovery. One of the oddities of this economy is the mismatch between fiscal and monetary policy. We are not economists, far from it, but while the Federal Reserve is raising interest rates to slow the economy, the Federal Government has dramatically increased spending. Per the chart below from the US Treasury, since 2018, Federal Outlays have gone up by more than 50% while the resulting deficits have doubled!

The Federal Government has approved $5.3 trillion in COVID relief from the beginning of the pandemic, starting with the massive $2 trillion Cares Act in March of 2020 and ending with the $1.9 trillion American Rescue plan a year later. Since then, another $2 trillion of spending has been approved in the Infrastructure Bill, the CHIPS Act and the Inflation Reduction Act. Conventional wisdom is that deficit spending is a tool that can be used to stimulate the economy when it falls into recession, but for the last two years, the Federal Government has been stimulating an already overheated economy. In response, the Federal Reserve, with one of the most rapid increases in interest rates in recent history, is trying to slow the economy in the face of massive fiscal stimulus. If monetary and fiscal policy were more in sync, would the Fed have had to raise rates so rapidly? That would seem logical but is still hard to tell. However, two outcomes are apparent: interest rate sensitive industries like real estate have suffered the most, and the rapid climb in rates has caused trillions of dollars of value loss in CRE.

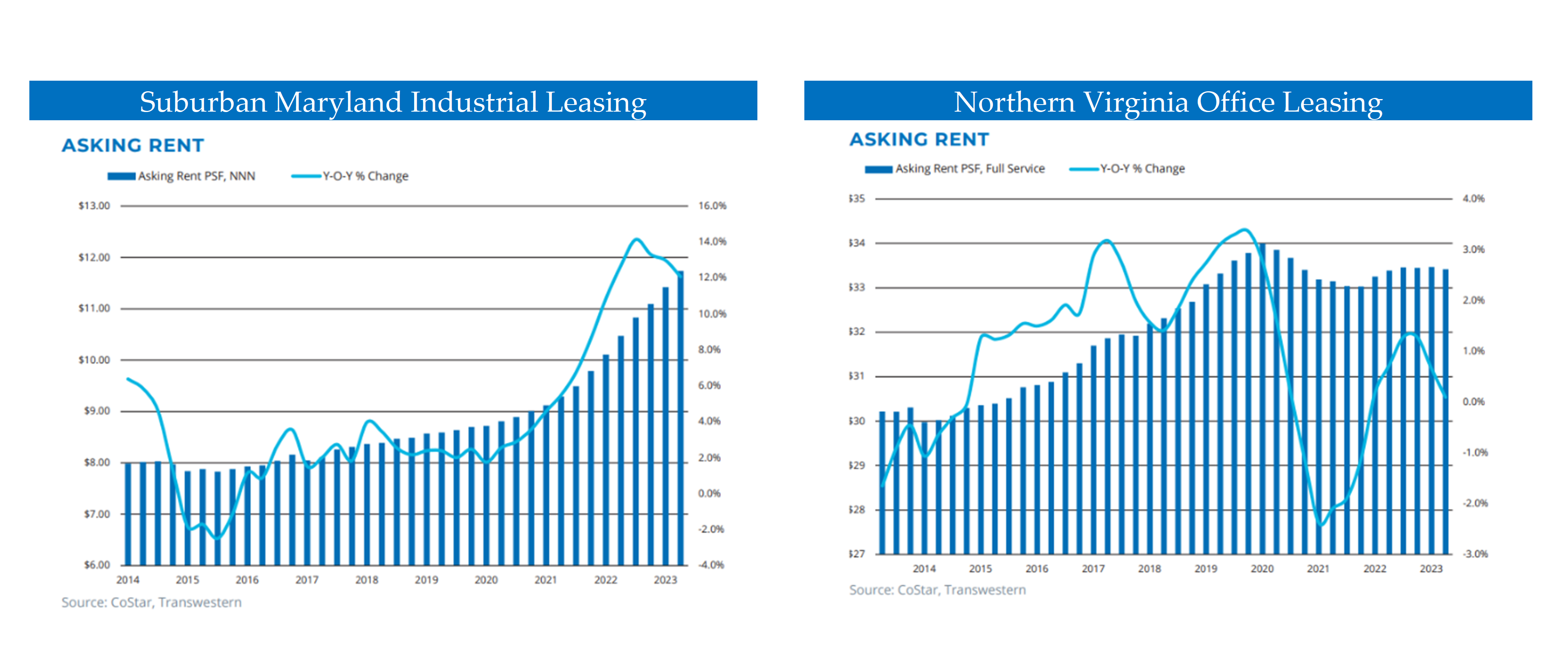

While there is no place to hide in this real estate market, it is important to point out the need for a diversified portfolio. Below are two charts from Transwestern’s Q2 report comparing office leasing performance with that of industrial. These are two property sectors in which we are invested. In comparing the Suburban Maryland industrial market to the Northern Virginia office market,

we see a striking difference. From the start of the pandemic these charts show a dramatic divergence in demand as reflected in rental rates. Significant growth in e-commerce has been driving a surge in demand for industrial space while work-from-home has resulted in negative absorption of office space.

Industrial values have held up better because bottom line net income has soared from the rising rental rates, while the opposite is happening in office. However, industrial construction is rising and will ultimately meet demand, while office construction has all but stopped entirely. In addition, demolition of obsolete properties and conversions of office to residential and other uses is reducing supply. All these factors are moving the office market to a healthier supply-demand balance over the intermediate term. Of course, we do not know when this will happen, reminding us of the necessity to be diversified.

Rapid interest rate increases, government fiscal intervention, and changes in the way businesses and individuals use real estate in the post-pandemic period are posing significant shock to the real estate investment industry. A cyclical buying opportunity will emerge when price discovery begins. In the meantime, high-quality assets that are well capitalized and a diversified portfolio will perform the best in this challenging environment.

“My hunch is… there’s going to be a unique money-making opportunity that people haven’t seen since the Great Recession.” (Chris Ludeman – CBRE Global President of Capital Markets)