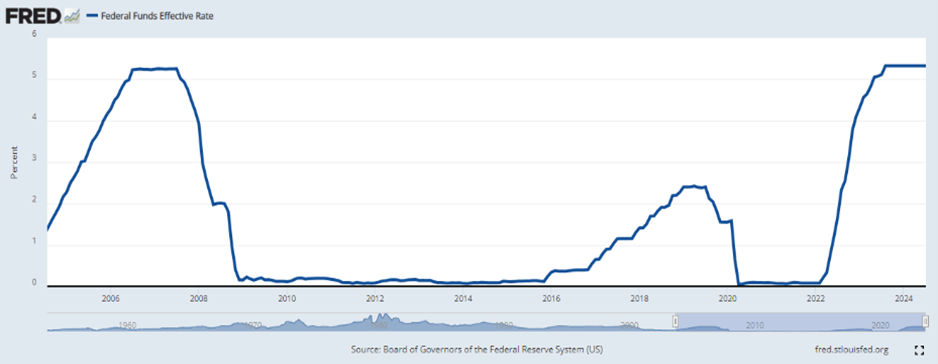

In the second quarter of 2024, commercial real estate continued to struggle as it has since the sudden rise of the Federal Funds Rate (FFR) which began in the spring of 2022. As the FFR has now been settled at its current level for the better part of a year (notably the highest level of FFR over the last 20 years), there has been rapt attention and widespread speculation as to when the Fed might begin to bring rates down.  At the same time owners, facing a challenging post-pandemic leasing and operating environment at the property level, are forced to react to the many changes in the way real estate is used, particularly office space. We will explore aspects of each of these challenges in this update.

At the same time owners, facing a challenging post-pandemic leasing and operating environment at the property level, are forced to react to the many changes in the way real estate is used, particularly office space. We will explore aspects of each of these challenges in this update.

Lenders and borrowers have begun to ramp up the disposition process on assets that are worth less than the debt they carry. There is even greater attention being paid to out-of-balance loans where there is some value remaining above the debt, but refinancing proceeds are only available at higher rates and lower proceeds. Like other interest rate sensitive industries, hope for value recovery or cheaper debt lies in lower interest rates, and market participants look forward to the next Fed interest rate meeting like eager Taylor Swift fans outside a sold-out concert venue.

While movement in the FFR is an important metric, it is surprising that there is far less focus on the Fed balance sheet. In 2022, the Fed began quantitative tightening (QT) by selling off treasury bonds and mortgage-backed securities, which theoretically (the Fed has never tried quantitative tightening to this extent) increases the supply of bonds in the market and raises interest rates. Since beginning this program, the Fed has reduced the assets on its $9 trillion balance sheet by $1.6 trillion. As JPMorgan Chase CEO Jamie Dimon pointed out in his annual letter to shareholders last month, “We have never truly experienced the full effect of quantitative tightening on this scale. The current pace of QT is draining more than $900 billion in liquidity from the system annually,” he said, adding, “I am more worried [about it] than most.” CNN, May 1, 2024.

The Fed had been selling off assets with a ceiling of $60 billion per month through the Spring and, as if listening to Jamie Dimon, announced they were dropping the ceiling to $25 billion in the second quarter of 2024. Could this relaxation of QT be regarded as a signal that the Fed’s next move is to reduce rates? Apparently, the markets think so. Since the announcement, Treasury yields have fallen on the long end of the curve, and the S&P 500 has risen by more than ten percent. With inflation now down to a YOY rate of three percent, a little welcome relief from a change in the direction of rates may be on the horizon.

Meanwhile, property owners wrestle with dynamic changes in demand. This is most evident in the troubled office building sector where, “The increase in vacancies has led to office buildings across the US being rendered ‘nonviable’. Our analysts define this as a building that is more than 30 years old, that has seen no renovations since 2000, and that has a vacancy rate higher than 30%. Roughly 4% of offices in the US fit those criteria.” Goldman Sachs – March 22, 2024.

In the post-pandemic era, we are amid a seismic shift in work habits, affecting the entire asset class. Well-located, high-quality office buildings that have been purchased at the right investment basis, and which offer tenants a wide array of amenities are doing reasonably well. Employers in these buildings find it easier to bring employees into the office. For the rest of the market, year after year longer term leases roll and net absorption of space remains negative. Across the country, owners who have spent a lifetime building quality office building portfolios are seeing an environment of which they have never dreamed. As Mark Twain wrote, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Any owner facing a major vacancy, pending rollover or debt maturity is looking at every potential option. Most of the focus has been on conversions to residential where the Washington Region is very active. “Leading the charge this year is the Washington, D.C., metropolitan area, where plans are underway to convert office space into 5,820 apartment units, an 88% increase from last year.” -Bloomberg, January 22, 2024. Cushman Wakefield is tracking almost 10 million square feet of B and C office space in downtown DC alone, where conversion is either complete, underway, or in some stage of planning. Most of these conversions are residential, but also include a smattering of hotels and educational uses. To support these revitalization efforts, The District of Columbia’s approved 2025 fiscal budget includes a “Central Washington Activation Program” tax incentive for converting office buildings into non-residential uses (hotels, retail and restaurants). It is important to note that this program is in addition to the existing office-to-residential “Housing in Downtown” tax abatement program.

In the Washington suburbs there may be even more activity, though it’s more oriented toward the demolition, rezoning, new-build arena versus straight conversion. Recognizing that the current changes in office occupancy are secular and not cyclical, local governments now understand the tax implications of non-economic uses. Lower density office parks with surface parking are being converted to townhouses and apartments, responding to the region-wide shortage of housing. Look for more suburban office buildings with surface parking to be demolished and rezoned for housing, retail, and other uses.

In an otherwise dismal office environment, conversions are a bright spot. They reduce the oversupply of office space, leading to a more rapid rebalancing of supply and demand. They also present a great opportunity to well capitalized developers and investors who can purchase office buildings at market bottom pricing or pivot existing properties to take advantage of the changes in demand. With the potential for a little help on interest rates, we just may be in the pre-season of a recovery for commercial real estate.