This might be the time when our update could simply be, “APRIL FORECAST IS CLOUDY. NEXT UPDATE IN JULY.” That statement is not only short, but also may be shortsighted, as we can only hope for more clarity by July! However, after fifteen years of market commentary every quarter, we are not about to allow some market uncertainty break our consistent streak. Despite tariff-fueled trade conflicts, cuts in government employment, threats to the judiciary and DOGE probing every part of the Federal Government, not to mention dramatic swings in the stock and bond markets, there are trends both locally and nationally that bear discussing. Investors are concerned about the Washington market, as we are, and in this update, we will review the prospects of the DC region and how different asset classes are faring.

The DC region’s economy has traditionally relied heavily on the Federal Government. While that continues to be true, this reliance has lessened over the years as the region has diversified its economic base. Today, Government civilian employment is approximately 10% of the region’s total employment with Department of Defense (“DoD”) employment being slightly more than 20% of total federal employment in the area. There is no doubt that the job and funding cuts will be painful, both at the individual level (we all know someone who has lost their government job) and for the regional economy; but this is a vibrant, diverse local economy which has weathered cuts in government employment before.

One of the pain points that is currently a hot topic is the effect of government cuts on the already troubled office market, particularly the downtown DC market. It’s a good news/bad news story. The good news is that the dynamics of the trophy and A+ markets have evolved to now favor landlords. With a trophy vacancy rate of 11%, only one new building under construction, and no new supply delivering until 2028, rents are finally rising in this sector. The broader Class A market, which carries a 19.5% vacancy rate, should also benefit as the trophy market tightens and tenants have fewer choices. On the demand side of the equation, trophy office-space users, including law firms, public affairs companies and lobbying firms are thriving in the current political environment and driving this positive momentum. On the bad news front, even though the Federal workforce is finally returning to the office along with other workers, the Class B and C office market is suffering with vacancy rates of 24% and 29%, respectively. With significant existing GSA tenancy and a declining demand among traditional lower price-point office users, owners of these assets face significant challenges. JLL points out that most of the office space occupied by GSA is B and C space and functionally obsolete in today’s office world. Many of these buildings are fifty to seventy-five years old, and even without government downsizing, would be ripe for conversion or demolition.

In the suburban office markets, Northern Virginia will fare better than Suburban Maryland. As the home of the Pentagon and most of the region’s defense contractors, Northern Virginia will feel less pain and experience some bright spots. While the DoD’s targeted top-line budget cut is 8%, “Defense Tech functions are being prioritized for growth, a silver lining for our region.” – JLL

The overall impact of actual GSA lease terminations across the region remains to be seen. From its peak of 58 million square feet in 2012, a bipartisan effort has steadily reduced the Federal office footprint by 15 million square feet over the last three administrations. As of this report, “…the Department of Government Efficiency’s list of other federal leases for termination in the DC Metro area is relatively meager. Of the 676 lease terminations across the federal leased footprint nationally (75% of which are under 10,000 sf), only 24 leases totaling 1.7 million SF have been targeted in the DC Metro region. These leases make up 4.0% of the region’s 43.3 million SF GSA leased portfolio and 0.56% of the overall DC Metro office inventory. Furthermore, many of these leases were already part of long-term federal plans to consolidate and/or move them to federally owned space.” – Cushman & Wakefield, Market Beat Q1 2025

Since it is uncertain where United States trade policy will ultimately end up, we hesitate to opine on the impact of tariffs. However, it appears that some level of tariffs will ultimately be put in place, and they will have an impact on the real estate markets. Of greatest concern are the effects of higher costs on the retail sector. Talking to retail brokers, we hear anecdotally that retailers who have major expansion plans are hitting the pause button. The industrial warehouse and distribution markets are also vulnerable. While the administration talks about increased manufacturing onshore, the near-term potential of a retail slowdown with reduced inventories and fewer goods coming from overseas will reduce demand for warehouse and distribution space in the immediate term. However, there is already a meaningful supply-demand imbalance brewing in the local industrial market stemming from massive tenant displacement from data center development in the region. This dynamic may mute any short-term impacts from tariffs and not show up in the industrial market for some time or until tariff policy becomes clearer.

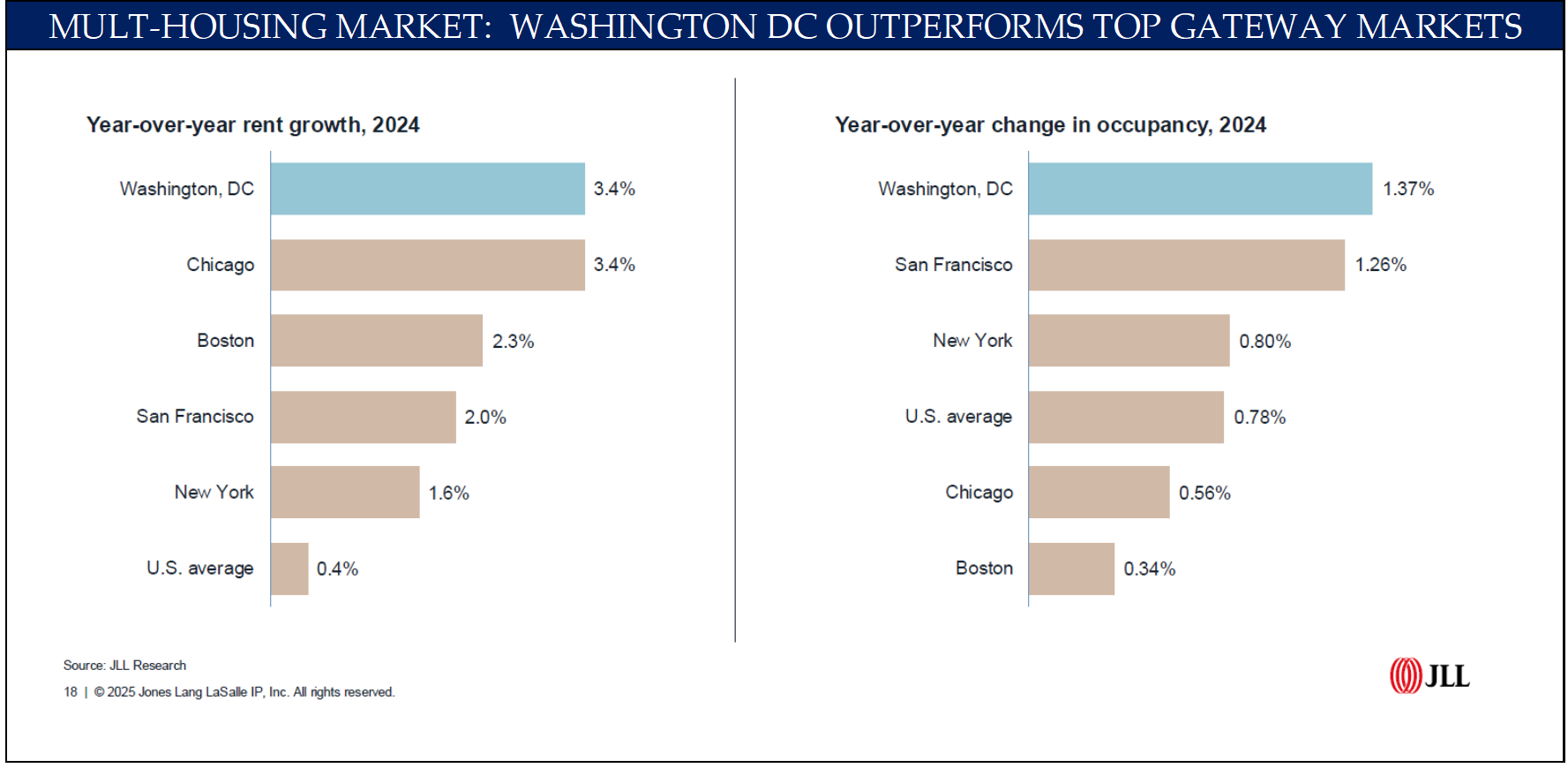

The apartment market remains vibrant after a healthy 2024 and the District of Columbia leads the way. As you can see from the accompanying chart from JLL, the Washington market led the country in rental rate growth and occupancy gains among major markets in 2024. Rent levels are lower than other major Northeast markets and the for-sale housing market remains near a historically low inventory level, continuing the housing shortage trend of the past few years. On the supply side, due to high interest rates and high construction costs, the number of units under construction is at the lowest level in over ten years. But for uncertainty around cuts in the federal workforce, apartment fundamentals in the region look solid for the next several years.

Remembering that the FORECAST IS CLOUDY, and uncertainty is high, we make the following observations. First, real estate values have fallen dramatically since 2022 with the significant rise in interest rates. Additional increases in rates, which are possible, would likely push values further down. However, with the steep drop in value experienced to-date, current values seem appropriate, with less risk than the public equity market. According to Green Street, “In the public market, REIT share prices have underperformed the S&P by nearly thirty percentage points, cumulatively, the last three years.” Also protecting the downside risk of real estate is the general control of supply across most product types due to higher interest rates and high construction costs (which may continue to increase with tariffs and potential labor shortages). At current pricing and fundamentals, real estate may provide a haven until the forecast calls for clearer skies.