In this period of daily doomscrolling and emotional angst that comes with each breaking news story, tweet or executive order, Danish author Andri Magnason asks us to expand our notion of time. He asks us to think about someone we love or will love and how long they will be alive. If you are a proud member of Generation X, you may have a grandchild years from now who will still be alive in 2125 or later. How does this change the way you think about the world in 2025? The investment world’s equivalent to this long-term perspective is Warren Buffet who famously said, “Our favorite holding period is forever.”

This may be pertinent to how real estate practitioners and investors view the Greater Washington market during this time of federal job cuts, contract cancellations, ICE and National Guard presence and yet another prolonged Government shutdown. For decades the Washington Region has traditionally been considered one of the safest real estate markets in the world. During that time, real estate investors referred to the area as recession proof or recession resistant because the economic effect of recessionary periods was muted by the consistent growth of government spending and employment. That traditional view is now being challenged. Our anchor tenant, the federal government itself, is being forcibly downsized and government contracts are being rescinded, leading to private sector job losses. While the Washington Region may be out of favor with some today, a longer-term perspective can provide some comfort. With the most educated work force in the country, the highest average salaries in the nation, dynamic cultural institutions, the leading data center market in the world, the headquarters of the US Military and our nation’s Capitol, Washington will continue to be a dynamic and relevant global city in the years to come. The current atmosphere is certainly chaotic, and the near term will be difficult, but the assets that the area possesses will provide support for a vibrant real estate investment market over the coming years, perhaps starting today!

Washington’s real estate community is pivoting in a way that supports a belief in the longer-term health of the Region.

Here’s what Cushman and Wakefield and CBRE are saying:

“Despite the downturn, job openings remained stable, single-family housing permits rose, and D.C.’s multifamily market showed strength, highlighting pockets of resilience.” – CBRE Research September 18, 2025

“After several years of heavy contraction, the region appears to be transitioning toward a more balanced phase, characterized by measured givebacks, selective expansion, limited new supply and growing confidence among large occupiers.” – Cushman & Wakefield Q3 Office Report Northern Virginia

This certainly does not sound like desperation or doom.

To be fair, the labor market is softening as both government jobs and contractor employment have fallen. While commodity office buildings suffer, trophy product continues to do well across the Region. In DC, trophy vacancy is 11% with little new supply on the horizon. Population in the Region is growing, and the housing shortage continues, fueling demand for both new single-family housing and apartments. In contrast to the office market, the multifamily housing market is one of the best in the country.

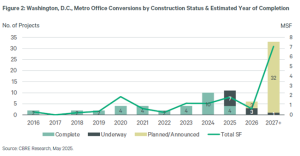

Another area in which the Washington Region is leading the country is in the conversion of obsolete office properties to other uses, most often residential. As you can see from the accompanying chart from CBRE, the pace of conversion activity is ramping up significantly. Over the last two years, over four million square feet of space has been removed from the office supply. As planned projects move forward, additional B and C office buildings will be repurposed. Local jurisdictions are providing incentives to encourage this transition. The District of Columbia offers a 20-year tax abatement program for qualifying projects, and a variety of other incentives to convert non-competitive office properties to other uses, and Montgomery County has recently established an accelerated approval process for office-to-residential conversions. The suburbs are just as active, as office parks are being demolished to make way for new residential and other uses. One major example is Erickson Senior Living’s transformation of the former Marriott International headquarters in North Bethesda into a 1,500-unit senior living community. We currently have projects in our portfolio that will convert over one million square feet of office to residential uses.

Another area in which the Washington Region is leading the country is in the conversion of obsolete office properties to other uses, most often residential. As you can see from the accompanying chart from CBRE, the pace of conversion activity is ramping up significantly. Over the last two years, over four million square feet of space has been removed from the office supply. As planned projects move forward, additional B and C office buildings will be repurposed. Local jurisdictions are providing incentives to encourage this transition. The District of Columbia offers a 20-year tax abatement program for qualifying projects, and a variety of other incentives to convert non-competitive office properties to other uses, and Montgomery County has recently established an accelerated approval process for office-to-residential conversions. The suburbs are just as active, as office parks are being demolished to make way for new residential and other uses. One major example is Erickson Senior Living’s transformation of the former Marriott International headquarters in North Bethesda into a 1,500-unit senior living community. We currently have projects in our portfolio that will convert over one million square feet of office to residential uses.

Cap rates on two of the most sought-after property types, apartments and industrial, have come down by approximately fifty basis points since 2024 and properties on the market for sale are receiving multiple offers. While some lenders are concerned about the Region in general, there is ample debt available to close transactions in these property types reflecting general credit loosening among regional and local banks for the right product.

Top of mind for many investors is concern about an asset bubble. Gold is up 48% YTD and Bitcoin is up 29%. The “Magnificent Seven” companies continue to lead the stock market. These companies are currently valued at $20 trillion, representing 37% of the value of the S&P 500. In 2025, the capital spending for these companies is estimated to total a staggering $350 billion or, in total, about 60% of these companies’ operating cash flow, according to JP Morgan. While the market has rewarded this spending with ever higher valuations, analysts are questioning whether the return on capital invested can support this unprecedented level of capital spend into the foreseeable future. This may signal the beginning of a cyclical rotation to both companies and asset classes that generate cash flow and healthy ROIC. Real estate would certainly be such an asset class.

With a long horizon, the current pricing of real estate assets, the potential for cyclical rotation, and most important, the underlying dynamism of the Washington Region, which has been created over decades, the opportunity exists to purchase or create quality assets that will generate both cash flow and asset appreciation for investors.

As Warren Buffet famously said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.”