A Hare was one day making fun of a Tortoise for being so slow upon his feet. “Wait a bit,” said the Tortoise; “I’ll run a race with you, and I’ll wager that I win.” Aesop’s Fables

This is probably the right time to employ the overused word “unprecedented” when looking back on 2025. Who would have thought at the beginning of the year that the East Wing of the White House would be demolished or that the President would initiate a hostile takeover of the Kennedy Center for the Performing Arts. The list could go on, but in the shadow of unprecedented happenings both internationally and domestically, the economy and financial markets have been steady. Inflation has been muted, economic growth continues, interest rates have peaked and are slowly coming down, and the equity markets have had a third straight year of double-digit returns. Economically, things could be a lot worse.

Commercial real estate continued its recovery in 2025. Modestly lower interest rates helped values bottom out in most real estate asset classes, and with generally lower supply on the horizon, markets entered the equilibrium phase of the cycle. You may remember a couple of years back when we counseled: “Stay alive till ‘25.” That has proven to be about the right timing for recovery of the property markets with the notable exception of some office markets. However, the debt market is another story. There are still many pre-2022 loans and “amend and extend” loans from the past couple of years that need to be recapitalized and are now staring at interest rate increases of 150-200 bps or more at refinancing. This is the wall of CRE loan maturities about which market observers continue to worry. While the 20-year average of loan maturities is $350 billion per year, maturities from 2025-2027 are estimated to be almost twice that amount.

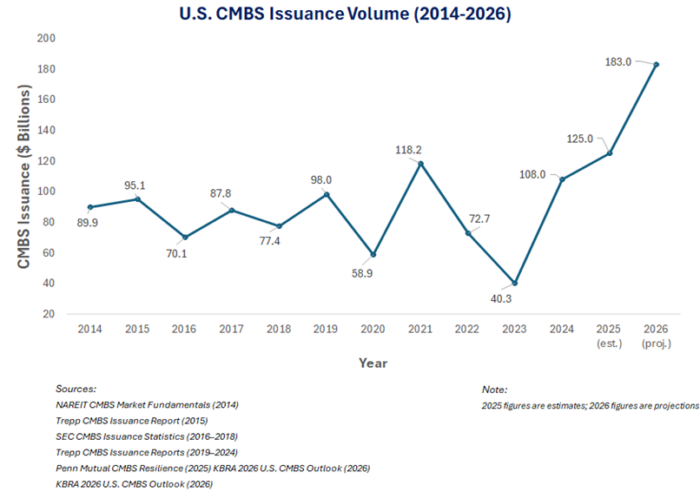

The good news is that many lenders returned to the market in 2025, and liquidity in the debt markets is anticipated to increase further in 2026. CMBS originations rebounded sharply, reaching record levels in 2025, with projections for another significant increase in 2026. As has been widely reported, 2025 was a profitable year for the banks despite their large real estate exposures. With seemingly ample loan loss reserves, stabilizing markets, and more conservative capital structures, expect banks to be active lenders in 2026 as they ward off competition from private debt fund lenders who have become a more significant player over the last few years. “Preqin data shows 87 real estate debt funds closed in 2025, raising an aggregate $32.7bn, up $12bn on the previous year’s total. Approximately 90% of total debt strategy capital raised last year was by North America-focused vehicles – the highest share since 2010.” – Preqin First Close January 13, 2026

The good news is that many lenders returned to the market in 2025, and liquidity in the debt markets is anticipated to increase further in 2026. CMBS originations rebounded sharply, reaching record levels in 2025, with projections for another significant increase in 2026. As has been widely reported, 2025 was a profitable year for the banks despite their large real estate exposures. With seemingly ample loan loss reserves, stabilizing markets, and more conservative capital structures, expect banks to be active lenders in 2026 as they ward off competition from private debt fund lenders who have become a more significant player over the last few years. “Preqin data shows 87 real estate debt funds closed in 2025, raising an aggregate $32.7bn, up $12bn on the previous year’s total. Approximately 90% of total debt strategy capital raised last year was by North America-focused vehicles – the highest share since 2010.” – Preqin First Close January 13, 2026

If 2026 is to be the year of recapitalization in commercial real estate, real estate equity investment will have to broaden to meet the moment. The environment appears ripe for this to happen. First, there is abundant capital on the sidelines and more being raised. Many of those investors are likely to be more active in 2026. Investments made in 2025 should reward many of the early movers, but that advantage will abate over the course of 2026 and 2027, creating some sense of urgency. Second, the property markets have slowly come back to equilibrium with future supply severely diminished for many product types, reducing the risk of a deterioration in property fundamentals. Third, hopeful owners have all but abandoned the notion that interest rates will go back to pre-2022 levels, and the market has adopted a “higher for longer” view towards rates, supporting more realistic valuations. Fourth, and perhaps most significant, institutional investors are increasing allocations to commercial real estate. Led by seven mega cap stocks that are competing for AI supremacy, the S&P 500 has risen by over 75% since the end of 2023, and the perceived risk in the equity markets is elevated. During that same period, real estate returns have essentially been flat or slightly down. Real estate returns over the long term are not expected to reach equity-like levels, but given the low correlation that real estate has with equity markets, its currently reasonable valuations, and natural inflation protection, allocations to real estate are increasing for many institutional investors.

While 2025 has been a difficult year for the Washington Region overall, across the various real estate product types, regional trends are generally tracking the US, with muted growth in rents and a significant drop in supply. The Industrial market continues to perform well with over two million square feet of net absorption across the region. While the vacancy rate at 7.9% is higher than it has been due to the elevated supply over the last few years (averaging in excess of 7 million SF per annum), only 2 million SF is currently under construction regionwide. This lack of supply, combined with continued strong demand, should push vacancy rates lower over the course of the year and place additional upward pressure on rents.

With a regionwide housing shortage still present, Multifamily absorption remained positive in 2025 despite significant federal employment cuts. However, with roughly 11,000 new units delivered in 2025 and absorption of a little over 4,800 units according to Cushman & Wakefield and CoStar, the region wide vacancy rate rose to 8.6%. Rents were down in portions of Maryland, Virginia and Washington, D.C., with DC rents falling the most in the region (-2.2%). The good news is that supply is falling sharply with about 6,000 units scheduled for delivery in 2026 (roughly half the recent historical average) and still fewer units slated for delivery in 2027. With new multifamily construction starts also trending below average pace, the vacancy rate should come down over the next few years as supply will remain substantially below historical averages for the foreseeable future. The region continues to gain population, and job growth was positive in 2025 outside of the federal sector, providing much needed stability in a chaotic year and signaling the region’s continued economic decoupling from the Federal government.

The Office market continues to present great challenges for owners and significant opportunities for investors. Washington, D.C. experienced 1.5 million SF of negative absorption and close to the same amount of office space taken from inventory for residential conversions, slowing the rapid rise in vacancy rates (20.8% according to Colliers). It is not a healthy sign, however, when removing space from inventory is the most influential metric for controlling rising vacancy. With only 400,000 SF under construction, a return to positive absorption will begin to bring the office market back to health, but it is challenging at best to predict demand in the current political and economic environment. One bit of good news is 2025 produced the first positive absorption of office space in Northern Virginia since 2019. With only 35,000 SF under construction in all of Northern Virginia and leasing momentum from technology, government contractor and data center related businesses, 2026 could be an inflection point for the beleaguered NoVa office market.

If there is a common theme emerging from 2025, it is property markets continuing the slow, steady climb back to recovery and balance. Higher interest rates and slower growth have forced a reduction in new supply across all property types, and conversions have further reduced supply in the office markets. Real estate trends often take years to play out. We are almost four years into this higher interest rate cycle, and the recovery has been marked by falling values, and limited liquidity. In 2025, markets bottomed out for the most part and buying opportunities emerged. Now, we believe 2026 and 2027 will see more buying opportunities and rightsizing of capital structures as full recovery takes place. It all takes time.

“Things are not always done by starts, You may deride my awkward pace, But slow and steady wins the race.” Aesop’s Fables – The Tortoise and the Hare