Early 20th century philosopher and poet George Santayana is famous for his warning: “Those who cannot remember the past are condemned to repeat it.” As we enter this period of inflation with high interest rates and a Federal Reserve committed to slowing the economy, it is worth considering what we have learned from past events. It may help us to better understand our current situation and to navigate the waters ahead.

The two most recent major downturns for the real estate markets were the Savings and Loan (“S&L”) crisis in the early 1990s and the more recent “Great Recession” resulting from the subprime mortgage meltdown. While each of these downturns was caused by different circumstances, they both were marked by a steep drop in real estate values.

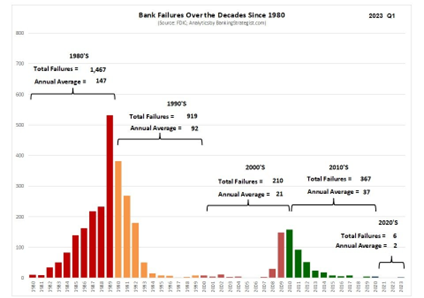

The S&L crisis resulted from a period of bank deregulation during the 1980s which led to excessive risk-taking by banks and particularly S&Ls. At that time, construction loans were being underwritten at as much as 100% of project cost. Bank failures during the late 1980s and early 1990s were significantly more prevalent than during the Great Recession. Interest rates, however, were not really a factor as rates were slowly falling during this period. Loan workouts and REO sales were the order of the day. What made the S&L crisis particularly difficult for owners of real estate was the lack of liquidity in the debt markets caused by bank failures, higher reserve requirements and the large number of loans that ended up with the FDIC and RTC. Even owners of the best properties with debt maturing had nowhere to turn to refinance their loans. Complicating matters further was the lack of liquidity in the equity markets as the real estate fund business was only in its beginning stages and was not the significant force that it is today.

The Great Recession certainly had a more dramatic impact on the broader economy than the S&L crisis; but the effect on commercial real estate was less severe due to TARP legislation and other Federal actions, ample liquidity in the real estate equity markets and more disciplined underwriting. The Great Recession did not see the rush of property foreclosures that marked the S&L crisis and lenders tended to work through problem loans in a more measured fashion.

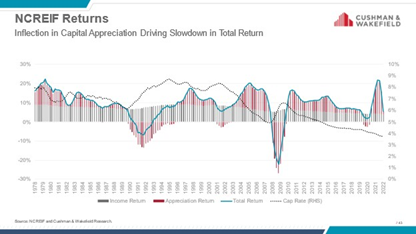

One final point to consider is the movement of cap rates. Going back to our history lesson, the accompanying chart shows that during the S&L crisis cap rates continued to increase for another five years, meaning a long and slow recovery and static real estate values. There was a saying  circulating amongst market participants in 1990: “Stay Alive ‘til ’95.” Now looking at the 2008-2010 period, cap rates once again rose as the recession took hold, but the increase was short-lived. While the Great Recession was severe, both public sector and private liquidity nurtured a more rapid V-shaped recovery in real estate values.

circulating amongst market participants in 1990: “Stay Alive ‘til ’95.” Now looking at the 2008-2010 period, cap rates once again rose as the recession took hold, but the increase was short-lived. While the Great Recession was severe, both public sector and private liquidity nurtured a more rapid V-shaped recovery in real estate values.

Let’s explore the similarities and differences between today and the previous two major downturns. As in the earlier periods, liquidity in the debt markets has become constrained. After almost a year of the current inflationary landscape, real estate lending continues to constrict. Banks are primarily short-term lenders and maintain liquidity by recycling capital. However, bank loans aren’t being paid off because property sales are not taking place and higher interest rates on bank loans are dampening demand. Add in significant loan loss reserve increases and very few banks will be active in real estate lending in the near term. What is different this time is the uneven nature of liquidity across asset classes. Multifamily and industrial are still attracting some capital due to moderating but favorable demand characteristics; but the lingering uncertainty in the office market has pushed many lenders to the sidelines. As a result, a significant number of office assets are likely to end up going back to lenders.

On the positive side, debt underwriting has remained conservative, more like the period leading into the Great Recession. There is also a lot of equity capital waiting for the right opportunities and there are now more private debt players in the real estate space than ever before. This capital should put a floor under the market and could provide for a more rapid recovery like the Great Recession.

What have we learned? With interest rates continuing to rise and very few transactions taking place, we do not have price discovery yet, which means we have not hit bottom and are in the early innings of this potential downturn. We do believe that more bank failures are likely. We have had very few bank failures over the last year compared to the prior two downturns, but history tells us there will be more. While money center banks are required to hedge their bonds,  regional banks are not. The bond portfolios of SVB, Sovereign and Credit Suisse have demonstrated the peril of being on the wrong side of a sudden interest rate move. Cap rates are likely to continue to rise over the intermediate term, which will affect asset values and further constrict the debt markets. Risks of contagion remain a possibility.

regional banks are not. The bond portfolios of SVB, Sovereign and Credit Suisse have demonstrated the peril of being on the wrong side of a sudden interest rate move. Cap rates are likely to continue to rise over the intermediate term, which will affect asset values and further constrict the debt markets. Risks of contagion remain a possibility.

Cushman & Wakefield offers sound advice, “The focus on structural demand drivers, defensive strategies, and on credit-, income-, and asset- quality remains a key theme throughout the CRE investment landscape.” (April 5th – Market Matters)

We subscribe to this advice, as well as the mantra: “Stay Alive ‘til ’25”.