Legendary New York Yankee manager Casey Stengel once quipped, “Never make predictions, especially about the future.” At this point in time, it is certainly sound advice. At the beginning of the year, the consensus view of the experts was that inflation had been tamed and that the Fed would lower rates two to three times over the course of 2024. Then, job growth accelerated in March and inflation clocked in at 0.4% month-over-month for the third consecutive month. The economy continues to be stronger than the Fed would like, providing continued upward pressure on interest rates. The ten-year Treasury rate has risen ~75 basis points since the beginning of the year. As we have mentioned in the past, the path to recovery is not straight.

Our mantra in this report has been, “stay alive till ‘25”, but with rates expected to come down this year, we were hoping to see recovery in late 2024. That looks unlikely at this point. If rates remain high for all of 2024, the mountain of challenged refinancings will only continue to grow.

“The lack of transactions and other activity last year, coupled with built-in extension options and lender and servicer flexibility, has meant that many loans that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2026, 2028 or in other coming years,” said Jamie Woodwell, Head of Commercial Real Estate Research at MBA. “These extensions and modifications have pushed the amount of CRE mortgages maturing this year from $659 billion to $929 billion.”

Almost a trillion dollars of maturities in 2024, along with the potential for high rates for the foreseeable future, will likely lead to lower values, more defaults, continued debt restructuring and distressed property and note sales.

This short-term pain will also lead to opportunities. One type of opportunity we are watching is for those properties where fundamentals remain strong, but values have been reduced because of higher interest rates. Think industrial, data centers and residential. Another opportunity lies in property types where fundamentals have eroded and combined with higher interest rates, values have plummeted. Think office, and to a lesser extent, regional malls.

In the former category, we like the data center and industrial sectors. The demand story for data center space is one of the most significant trends in the CRE market today.

“Over the next 5 years, the Data Center sector is arguably the best positioned commercial property type across the globe.“ Green Street April 22, 2024

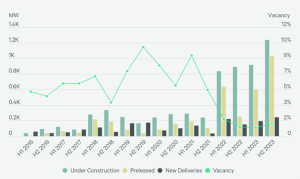

Northern Virginia is the leading data center market in the world and is ground zero for developing the infrastructure to power the AI driven evolution of the digital economy. The world’s largest companies are in an arms race to maximize computing capacity to service the next generation of cloud demand. The eye-popping growth of data center pre-leasing in Northern Virginia in the accompanying chart from CBRE Research tells the demand story.

center market in the world and is ground zero for developing the infrastructure to power the AI driven evolution of the digital economy. The world’s largest companies are in an arms race to maximize computing capacity to service the next generation of cloud demand. The eye-popping growth of data center pre-leasing in Northern Virginia in the accompanying chart from CBRE Research tells the demand story.

Driven by onshoring of the supply chain and continued growth of ecommerce, the future demand in the industrial sector looks solid. While not experiencing the generational shift of the data center sector, the industrial sector should still see positive absorption over the next few years, although perhaps not at the same pace as the post-Covid years. Last year saw muted leasing activity in the Washington Region in the face of economic uncertainty. However, absorption was still positive, and vacancy rates remain low. While there are over two million square feet under construction across the region, industrial construction starts have slowed. Vacancy levels may rise over the short term, but coming off the current historically low vacancy rate, rents should continue to rise due to the strong long-term demand picture.

Driven by weak fundamentals and higher interest rates, plummeting office valuations have started to attract distressed investors. In our Q4 2023 report, we highlighted several sales of Washington DC Class B-quality office buildings with vacancy problems that traded at one third of their peak value. The question remains, is this the right time to buy?

Let us look at a recent important sale in downtown Washington D.C. A 180,000 square foot, Class A office building located at 1099 New York Avenue recently sold. The building was built in 2007 and had been recently renovated. There was robust bidding for the property, indicating that quality office properties can still attract capital, but the ultimate pricing, ($530 per square foot) was approximately 50% below replacement cost. A majority of the building’s tenants had expanded or extended their leases since the onset of the pandemic, resulting in the building boasting a weighted average lease term (WALT) of almost ten years. Yet, it sold at a cap rate of approximately 9.25% and a conservatively leveraged cash yield of 11%. Is this a good investment? Through a historical lens, it certainly looks to be. Because of the uncertain demand picture for office, the market priced this asset at a high cap rate, a major discount to replacement cost, and a double-digit leveraged cash flow yield. While the buyer is well insulated from short-term market fluctuations, the longer-term negative trends for office could create problems down the road. We’ll see.

After all, as Yogi Berra said, “The future ain’t what it used to be.”