It is tempting to join the conversation about the political, economic and health crisis that our country faces because we have all been disrupted by the events of the past year. Any review of 2020 would reveal a dramatic increase in the use of the word “unprecedented,” whether related to the ongoing pandemic, our shocked economy, or our shocking politics. We will resist the temptation to exercise our journalistic prowess and stay focused on the impact of recent events on our existing assets, our market, and the overall real estate investment climate.

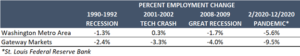

Like other markets across the country, the Washington region has seen an increase in unemployment which has affected both the office and multifamily markets. However, as can be seen on the accompanying chart the percentage drop in employment in the Washington area is significantly less than  in other Gateway markets, proving once again the recession resistance of the greater Washington region. Federal employment has grown in the face of the pandemic and the drop in Professional and Business Services employment has been minimal. These are the two largest sectors driving office demand.

in other Gateway markets, proving once again the recession resistance of the greater Washington region. Federal employment has grown in the face of the pandemic and the drop in Professional and Business Services employment has been minimal. These are the two largest sectors driving office demand.

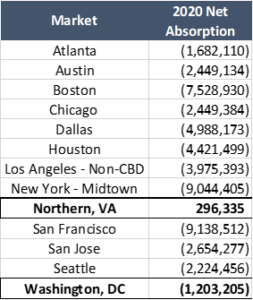

The accompanying chart from Cushman & Wakefield shows how the  job picture is reflected in the office market’s performance. As we have discussed in past reports, Northern Virginia is faring better than downtown Washington, and both markets are weathering the storm better than the rest of the country. Northern Virginia is one of the few markets in the country that saw positive net absorption in 2020, due mostly to sizable government spending, the active government contractor market and Amazon HQ2. Net absorption is the best indicator of market health because it measures the total change in leased space from one period to another.

job picture is reflected in the office market’s performance. As we have discussed in past reports, Northern Virginia is faring better than downtown Washington, and both markets are weathering the storm better than the rest of the country. Northern Virginia is one of the few markets in the country that saw positive net absorption in 2020, due mostly to sizable government spending, the active government contractor market and Amazon HQ2. Net absorption is the best indicator of market health because it measures the total change in leased space from one period to another.

Notwithstanding the relative positive performance of the region, it would be naïve to suggest that there are not bumps in the road ahead for the office sector as we emerge from the pandemic and office users determine how and when they return to the office.

The residential picture is more mixed. For-sale housing prices have risen, and demand is strong, driven by low interest rates, a lack of inventory and a broad millennial move out of urban apartments to more suburban for-sale product. Multifamily rents have fallen because of the shift in millennial preferences, the continued delivery of new product and by job losses in employment sectors which tend to have a high percentage of renters. Vacancy rates in Class A apartments rose to the 6% range, up from historic lows of around 3%, while Class B vacancy rose less steeply to 3.7%. High-rise urban multifamily product has struggled the most in our region, which is consistent with what is happening in other major markets across the country.

Despite falling rents, apartment values have remained stable due to historically low interest rates, and the expectation that demand will rebound. Home ownership is still out of the grasp of many workers and the lack of affordable homes remains a major issue. While rental demand was down in 2020, projections from Delta Associates show vacancy rates falling and rents stabilizing by 2022.

There is a strong correlation between the events of 2020 and the performance of real estate today and in the future, and those who will prosper, emerging from these times, will be the ones who can absorb all that is happening in an actionable way. In one sense investment in real estate is very simple: the industry works to understand what the consumer of real estate wants (the homeowner, renter, shopper, corporation, etc.), or will want in the future, and provides it. It is easy to say, but hard to execute. Today, it is particularly difficult because life across the country and the world has been disrupted in an “unprecedented” way. While it is not clear what the new normal will be, the ability to be nimble and adapt will be critical.