For much of 2022, the FED has been able to walk the economic tightrope between runaway inflation and recession. It appears the rapid increase in the Federal Funds Rate is beginning to control the rise of inflation. While growth in new jobs has slowed, we are not yet in recessionary territory. However, job growth is a lagging indicator, and the FED actions should continue to slow the economy. The FED cannot afford to have a rebound of higher inflation, and restrictive policies will continue for the foreseeable future with inflationary pressures exacerbated by an historically low unemployment rate (3.5%). “I would say it’s our judgment today that we’re not at a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes would be appropriate.” – FOMC Chair Powell, December 14, 2022

With a target inflation rate of 2%, which the FED projects to achieve by 2025, look for elevated interest rates to persist for the foreseeable future. Countering this “higher for longer” perspective are emerging questions in the economic community as to whether the 2.0% target remains an appropriate and relevant goal.

Ironically, the current direction of the labor market may help demand in the office market. We are already beginning to see a shift in the power dynamic between employers and workers, which should continue as the economy slows. Workers who had multiple job options a year or two ago are now just happy to have a job (Microsoft and Google recently announced layoffs of 10,000 and 12,000 employees, respectively). As we have stated before, most employers would prefer to have their employees in the office. However, competition for talented workers has been forcing employers to be more flexible than they would like, particularly regarding work from home. That dynamic is beginning to change. Look for more and more workers returning to the office in 2023.

Office owners could use a bit of good news this cycle. Low demand for office space continues to erode office values, particularly in Class B and C space, and higher interest rates are contributing to this loss of value as well. This is not a good time to sell an office building, and the dramatic drop in transaction volume reflects that. Looking over the horizon there may be a couple glimmers of light. Struggling office fundamentals, higher interest rates and the prospect of a slowing economy should dramatically reduce speculative construction. If workers continue to come back to the office and leasing demand picks up, we should see a better balance between supply and demand. Further, in Washington DC alone, 14 older office buildings totaling 3.2 million SF have announced plans for conversion to residential use. Assuming these buildings are fully vacant today, office occupancy should improve by approximately 200 bps. If these buildings are partially leased, and tenants are displaced into other buildings, the occupancy percentage could improve even further. We predict 2023 will not be favorable for office sales, but as the market bottoms and employees continue to spend more time in the office, look for recovery in 2024.

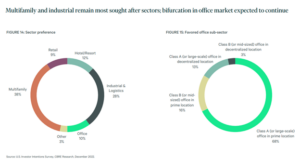

Almost every market participant is predicting reduced transaction volume for real estate in 2023 with multifamily and industrial properties once again the most sought-after property types. The results of the most recent CBRE Investor Sentiment Survey below reflect the attitudes of the largest institutional real estate investors and their interest in investing in multifamily and industrial properties.

Although both property types have long-term positive demand dynamics, their values will still be negatively affected by higher interest rates in the short-term, particularly considering the historically low cap rates seen in the latter half of 2021 and early 2022 in these sectors. A mere 75 bps move in cap rates in core properties within these preferred asset classes will impair value without significant, counter-balancing NOI growth. As a result, look for lower transaction volume in these property types in the near term as the market goes through price discovery in this new interest rate environment.

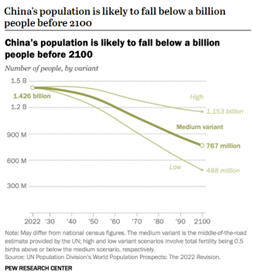

While discussing demographics in China might seem like mission drift for a local real estate company, there is nothing more important to real estate values than demographic movements, and the projected population demographics in China from the UN are unprecedented. As deaths exceeded births in China, its population shrank in 2022 for the first time in 60 years. What do the dual challenges of a falling and aging population mean for China and, ultimately, the US economy? (The brief article from PEW Research Center https://pewrsr.ch/3irzrFN is worth reading.)

Leonardo Da Vinci has been quoted as saying, “Everything is connected to everything else.” Certainly, that quote applies to our economy and that of China’s.

Much has been written recently about supply chain issues, which have implications for industrial, retail, and residential real estate. The surge of manufacturing and onshoring in the US is one of the drivers of the currently robust industrial real estate market. As the largest consumer market in the world, the US should be concerned about the productive capacity of our largest supplier, China. “The Chinese economy is entering a critical transition phase, no longer able to rely on an abundant, cost-competitive labor force to drive industrialization and growth.” – HSBC chief Asia economist Frederic Neumann

We continue to monitor these economic headwinds and their application to our local market and our current portfolio. While we remain vigilant with respect to the performance of our existing assets, particularly our office assets, we foresee a significant buying opportunity emerging in the next 24 months with a deluge of debt coming due in an environment of declining property values and dramatically increased borrowing costs.