As we reflect on the past year and look forward to 2025 in this Market Update, we will look back at the economy, its effect on the property markets, and at the end of this overview, make some observations about the housing market.

When interest rates began their meteoric rise almost three years ago, our advice was to “Stay Alive until ’25.” Notwithstanding the evolving political environment and the challenge of sorting rhetoric from achievable policy, there is certainly more clarity in the property markets today than when we originally made that statement.

Prior to the recent inflationary period, the economy experienced an ultra-low-interest rate environment from 2020 to mid-2022. In August of 2020, the 10-year treasury rate was 0.52% before climbing to 1.75% by March of 2022. Today the rate is 4.52%. This period of low interest rates fueled a dramatic increase in property values.

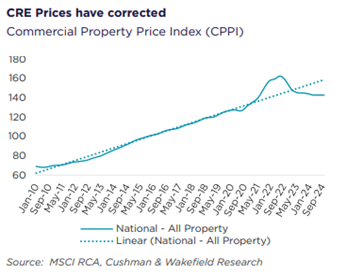

As you can see from the accompanying chart from Cushman and Wakefield, over that ultra-low-interest rate period, the MSCI Real Capital Analytics national property index soared by 22% (a 12.6% annual growth rate, more than triple the historical rate of 4%). A pricing bubble was forming, and this outsized growth was unsustainable. A correction had to come, and it came fast and hard with the onset of inflation and the accompanying steep rise in interest rates.

As we enter 2025, the property markets have absorbed the boom and bust of the last five years and are now entering a more balanced period. After a drop in real estate values of 20-30% since mid-2022, we are likely at the end of the down cycle, according to Richard Barkham, Global Chief Economist for CBRE. Kevin Thorpe, Chief Economist, Cushman & Wakefield writes, “Pick your number: expected returns vs. corporate bonds, cap rates vs. treasuries, debt spreads—they all signal that CRE pricing is nearing or back to equilibrium across most product types.” He goes on to write, “Demand for property remains mixed but is generally healthy overall. Demand for data centers, apartments, experiential retail and high-quality office is better than just healthy—it’s thriving.”

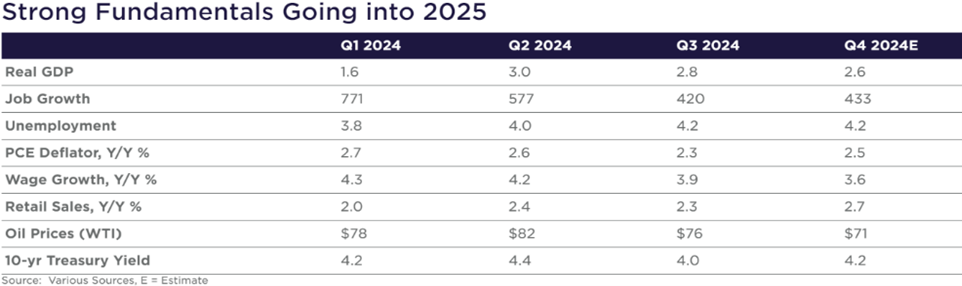

Transactional activity changed significantly over the course of 2024.  At the beginning of the year, it was a good time to buy if you had capital. There were few competitors, and debt was hard to source. As we enter 2025, the fundamentals of the economy appear to be back on solid footing (see the accompanying chart from Cushman & Wakefield). The fear of recession and runaway inflation has abated, and institutional investors are returning to the market, leading to more competitive bidding for quality properties.

At the beginning of the year, it was a good time to buy if you had capital. There were few competitors, and debt was hard to source. As we enter 2025, the fundamentals of the economy appear to be back on solid footing (see the accompanying chart from Cushman & Wakefield). The fear of recession and runaway inflation has abated, and institutional investors are returning to the market, leading to more competitive bidding for quality properties.

Your House may be your Best Investment

While commercial real estate values have experienced little growth overall since 2020 (see the chart on the prior page), single family home prices have risen by an average of 40% across the country and by as much as 80% in some markets. What is surprising is how prices have held up in the face of headwinds that should otherwise erode value. The combination of a dramatic rise in mortgage rates, significant increases in the cost of insurance, and rising real estate taxes all make ownership of a home more expensive, and should, in theory, drive prices down. And yet, home prices continue to make gains.

The driver of these most recent gains is a mismatch between supply and demand, particularly for single family housing. Coming out of the sub-prime crisis of 2008 and 2009, mortgage underwriting became more stringent, making it harder for individuals to qualify for loans, which reduced the rate of homeownership and led to rapidly improving multifamily fundamentals that, in turn, then fueled a surge in multifamily development. In the Washington region, in addition to stricter mortgage underwriting, policies to contain urban sprawl, lack of available land, NIMBYism and stricter environmental regulations all had an adverse impact on single family supply. Although the undersupply of single family housing was mitigated by a boom in multifamily construction, we have still significantly underproduced the amount of housing that is needed in the region overall.

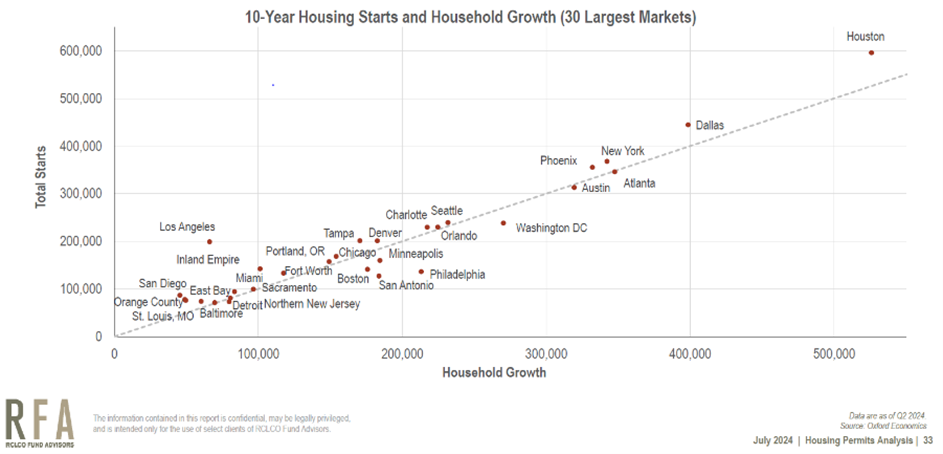

Currently, the local home sale market is marked by very little supply of new or existing homes and, in 2024, we saw the lowest level of home sales in years. That was predominantly due to the “lock-in effect” for homeowners who need a different housing situation but have a low current mortgage rate that they do not want to, or cannot afford to, give up. The last year demonstrated simple economics: Low supply coupled with strong demand leads to rising prices, and this imbalance is set to persist over the near term. During the last ten years, the Washington Region has been one of a few major markets that demonstrated substantiative household formation growth but also undersupplied the necessary housing units to meet this increasing demand.

This dynamic is not lost on the real estate investment community. Witness the birth of single family rental property as an institutional asset class unto itself. In an environment where underwriting single-family loans is more stringent and higher rates make it harder to qualify for loans, renting a house is an attractive solution. Despite the headwinds mentioned above, we will see more for-sale product come online in the region, but perhaps not enough to meet demand in the near term. A significant governor on supply is the changing dynamics of the homebuilder industry. According to Ivy Zelman, EVP and Co-Founder of Zelman & Associates, in 2000 only 8% of the units delivered nationally were built by the publicly traded homebuilders. Today, that number is 54%. In 2005 and 2006, the public homebuilders were focused on top line growth and were furiously building communities and aggressively buying land for their pipeline. Today, they are more focused on the bottom line and cash flow, and much less willing to take entitlement and zoning risk.

This dynamic is not lost on the real estate investment community. Witness the birth of single family rental property as an institutional asset class unto itself. In an environment where underwriting single-family loans is more stringent and higher rates make it harder to qualify for loans, renting a house is an attractive solution. Despite the headwinds mentioned above, we will see more for-sale product come online in the region, but perhaps not enough to meet demand in the near term. A significant governor on supply is the changing dynamics of the homebuilder industry. According to Ivy Zelman, EVP and Co-Founder of Zelman & Associates, in 2000 only 8% of the units delivered nationally were built by the publicly traded homebuilders. Today, that number is 54%. In 2005 and 2006, the public homebuilders were focused on top line growth and were furiously building communities and aggressively buying land for their pipeline. Today, they are more focused on the bottom line and cash flow, and much less willing to take entitlement and zoning risk.

Another major impediment to housing production in the Washington Region is the difficulty in creating enough finished lots. There is a shortage of residentially zoned land for building the needed single family and townhouse products. As a result, the bulk of the supply of new lots will come from the re-zoning and subsequent repurposing of infill office properties. These re-zoning/redevelopment projects are challenging. Local jurisdictions profess the need for more housing but impose costly proffer requirements which raise the cost of the land and require ever-longer and more complicated re-zoning processes. Because it takes years for lots to come online, the pace of housing supply will still be tempered in the near term. Thus, a more balanced market is likely at least a few years off.

The dynamic of the current housing market is instructive to any real estate investor. Investors often overvalue the importance of buying property at a good price. However, the value of owning property where the supply/demand dynamic is in your favor is, as the ad says, “Priceless”.