Last quarter we suggested that the “Forecast is Cloudy” and that our July report might provide more clarity, both on the political front and on the course of the financial markets. While we do believe there is more clarity, what is less clear is whether that clarity is actually good news. At the end of the first quarter, the specter of extensive and severe tariffs across the world created concerns about both recession and inflation; DOGE was freewheeling through government agencies promoting severe cuts in programs and personnel; and the fixed income and equity markets were on a daily rollercoaster ride.

Here we are in July, and while political tensions remain high, some clarity is emerging on how tariffs are being used, the direction of financial markets, and the Federal spending budget. It appears that the administration is not committed to tariffs as a financial tool, but rather as a negotiating lever for political purposes. The markets have discounted the likelihood that tariffs will be as broad or as severe as originally proposed. Avoiding a technical recession, the S&P 500 rose almost 11% in the second quarter and bonds returned 4%. With the passage of the Trump budget through the reconciliation process (the “One Big Beautiful Bill Act”), whether one likes it or not, there is more clarity on the future direction of federal spending and its impact on the economy.

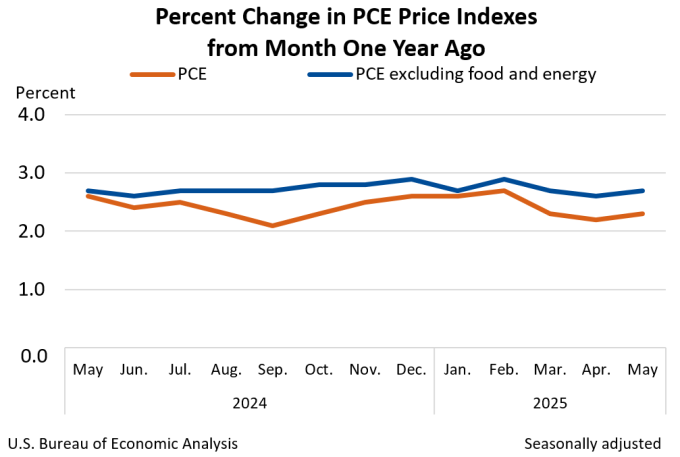

As the Federal Reserve prioritizes controlling inflation and exhibiting caution regarding the poten tial inflationary impact of tariffs, it has continued to hold rates at current levels. Per the accompanying chart, the Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE), rose 2.3% in May. Excluding the volatile food and energy sector, PCE rose 2.7%. These increases are still above the Fed’s 2.0% target rate. While the economy has certainly slowed, job growth continues to be positive. We are in a period of inflation stubbornly above the Fed’s target paired with slowing growth in the economy and labor market. This dynamic has raised concerns in the financial markets and among economists about the continuation of high rates and a slowing economy, and dour economy watchers have begun to re-introduce dreaded “stagflation” into the public discourse.

tial inflationary impact of tariffs, it has continued to hold rates at current levels. Per the accompanying chart, the Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE), rose 2.3% in May. Excluding the volatile food and energy sector, PCE rose 2.7%. These increases are still above the Fed’s 2.0% target rate. While the economy has certainly slowed, job growth continues to be positive. We are in a period of inflation stubbornly above the Fed’s target paired with slowing growth in the economy and labor market. This dynamic has raised concerns in the financial markets and among economists about the continuation of high rates and a slowing economy, and dour economy watchers have begun to re-introduce dreaded “stagflation” into the public discourse.

After Trump made his global tariffs announcement on April 2nd, the bond market quickly began to drop, forcing the administration to push back tariff implementation dates. At 140 trillion dollars, the fixed income market is larger than the 115 trillion-dollar global equity market, and movement in rates has far-reaching consequences across the world. Falling bond prices and rising borrowing costs, the downgrading of US credit and the likelihood of larger US deficits in the future all have increased risk for the US economic picture. Global investors are concerned about a bond market which continues to be awash in US government debt which crowds out private borrowers and forces private sector borrowing costs to rise. While the Trump administration puts pressure on the Fed to lower rates, the bond market is signaling to the Trump administration that it wants inflation controlled, and there is little confidence tariffs will deliver the goods.

Meanwhile, the Washington region has been at the center of Federal restructuring and job cuts, causing local market participants to pause and look for more clarity on the way forward. Despite these legitimate concerns, CBRE’s REVIVE Regional Vibrancy Index for DC rose 0.9% from the previous month’s analysis to 72.5 out of 100 in May, boosted by improved investor sentiment and continued increases in mobility and visitation scores, according to Ian Anderson, CBRE’s senior director of research and analysis. This index fell from December to February as the new administration rolled out its agenda but has since turned positive. Given some upbeat signs in the apartment, trophy office and hotel markets, plus the return-to-office momentum of Federal workers, there are green shoots developing that may signal a more stable market on the horizon.

Local transaction volumes are picking up and expected to exceed 2023 and 2024 annual sales. We know there is abundant capital on the sidelines, and we are seeing more offers for properties in the multifamily and industrial sectors, in particular.

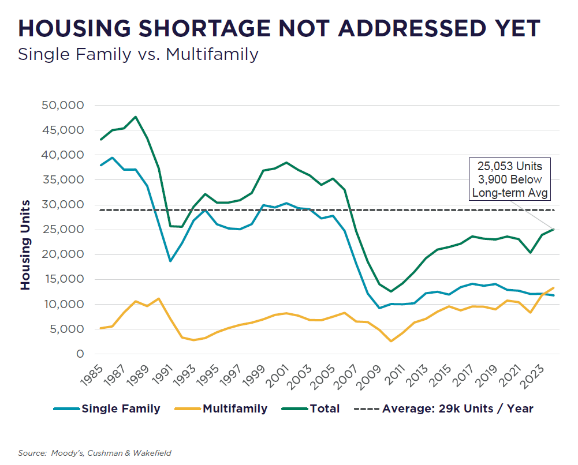

While the upward pressure on prices in single-family housing is easing somewhat, there is still a chronic shortage of supply, which you can see on the accompanying chart from Cushman and Wakefield. New single-family housing starts plummeted after the financial crisis of 2008 and are still less than half of the long-term average. Even with the recent increases in multifamily starts over the last decade, the total number of housing units delivered still trails the long-term average and hasn’t met or exceeded this average in almost two decades, creating this chronic undersupply and leading to metro-wide rent growth which is 50% higher than the US Average.

While the upward pressure on prices in single-family housing is easing somewhat, there is still a chronic shortage of supply, which you can see on the accompanying chart from Cushman and Wakefield. New single-family housing starts plummeted after the financial crisis of 2008 and are still less than half of the long-term average. Even with the recent increases in multifamily starts over the last decade, the total number of housing units delivered still trails the long-term average and hasn’t met or exceeded this average in almost two decades, creating this chronic undersupply and leading to metro-wide rent growth which is 50% higher than the US Average.

Notwithstanding the downsizing of the federal workforce, activity in downtown DC is on the rise. With federal workers returning to the office, demand for apartments has increased as workers want to be closer to where they work. Metro ridership is up significantly as are hotel occupancies. While there are market challenges that remain, the increased clarity feels like stability, or at least it appears that’s what the capital markets seem to think.