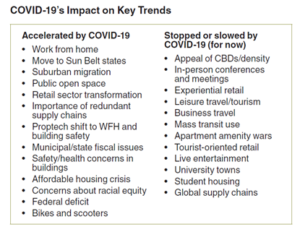

The 42nd addition of Emerging Trends in Real Estate takes a comprehensive look at the status of investment real estate in the United States. This recently published version, sponsored by the Urban Land Institute and PWC, highlights the uncertainties we are facing across trends, markets, and product types. The accompanying chart from the report lists those trends that have been  accelerated by COVID-19 and those that have been slowed or stopped. It is a lot to absorb. Each of the trends in the accompanying list has implications for real estate, and each is complex in its effect on the industry. Take work from home (WFH) as an example. The growth in WFH has implications for office space as users seemingly will need less space, and at the same time will affect the housing market as demand for more space at home grows. Also, let’s not forget the implications for technology where security of the home computer and ample internet access will become essential. This of course leads to racial and economic equity issues as quality internet access, home computers, monitors, printers and other equipment need to be equalized across race and economic strata. The point is that the way we live has changed due to the pandemic, and we are rapidly evolving to a new future.

accelerated by COVID-19 and those that have been slowed or stopped. It is a lot to absorb. Each of the trends in the accompanying list has implications for real estate, and each is complex in its effect on the industry. Take work from home (WFH) as an example. The growth in WFH has implications for office space as users seemingly will need less space, and at the same time will affect the housing market as demand for more space at home grows. Also, let’s not forget the implications for technology where security of the home computer and ample internet access will become essential. This of course leads to racial and economic equity issues as quality internet access, home computers, monitors, printers and other equipment need to be equalized across race and economic strata. The point is that the way we live has changed due to the pandemic, and we are rapidly evolving to a new future.

Three trends that we have been investing around are suburban migration, e-commerce and affordable housing. Suburban centers have been developing and are continuing to add urban amenities. As millennials age, get married and have children they are looking for more house and more outdoor space. As millennials move out, companies follow, lowering their cost of real estate and creating a competitive advantage for themselves in the search for top talent.

E-commerce has fueled a boom in industrial real estate. With the increase in online orders, delivery times have frustrated the consumer and many products have not been available. Increases in inventory from technology driven “Just-in-time” delivery moving to a “just-in-case”, reshoring or onshoring to streamline the supply chain, and continued demand for last-mile fulfillment centers have all created new demand for industrial space.

While the coronavirus has accelerated this growth in e-commerce, it has also advanced the decline of bricks and mortar retail. Traditional retail in-store demand is under pressure across the board. Department store sales dropped 29% between 2009 and 2019. Retail will not go away, but the next few years will require the repurposing of massive amounts of retail spaces large and small, creating interesting redevelopment and investment opportunities.

Housing and particularly affordable housing is dramatically undersupplied in the Washington DC region. The Urban Institute and Greater Washington Council of Governments estimate that the region is under supplying its housing needs by more than 10,000 units per year. Additionally, 47% of renters in the region are spending more than 30% of their income on rent and utilities, a sign of overburdened housing costs. The region has been on a ten-year apartment development binge, but those units are responding to only the top level of demand. More robust strategies for addressing the “missing middle” and work force housing needs will be rewarded moving forward.

of overburdened housing costs. The region has been on a ten-year apartment development binge, but those units are responding to only the top level of demand. More robust strategies for addressing the “missing middle” and work force housing needs will be rewarded moving forward.

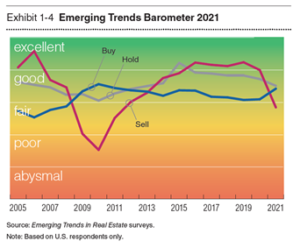

Turning to the investment market, transaction volume has dropped significantly. This is consistent with past recessions. The dramatic drop in GDP earlier this year was rapid and severe as the country locked down in March. While there is still abundant equity and debt capital in the system, buyers are looking for the COVID discount. Sellers on the other hand are not jumping to accept lower than expected prices. This widening of the bid/ask spread will last until there is more visibility on the prospects of various real estate product types, the economy, and the pandemic.

The accompanying chart reflects national investor sentiment that we are moving to a buyers’ market. Locally, we are experiencing the downside protection that the Federal presence provides and have not seen significant distress outside of the retail and hotel sectors; but, we believe there will be ample buying opportunities in the future as the ongoing impact of the pandemic works its way through the economy. Nevertheless, while we had anticipated putting some properties on the market this year, we are waiting until some of today’s uncertainties are behind us.