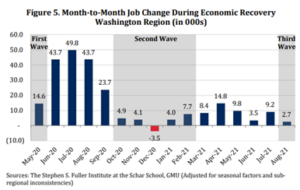

The US economy is drifting through a period of uncertainty, and the Fed is trying to strike the right balance between nurturing sustainable economic growth in light of the rise and fall of virus cases, while also controlling emerging inflationary pressures. Looking at the chart of employment changes in the Washington Region to the right, the correlation between the surges in the pandemic and employment growth (think economic growth) is evident. This trend is mirrored in markets across the country and if additional waves of the pandemic emerge, it is likely to persist. As we quoted Dr. Fauci in Q2 2020, “You don’t make the timeline, the virus makes the timeline.”

The US economy is drifting through a period of uncertainty, and the Fed is trying to strike the right balance between nurturing sustainable economic growth in light of the rise and fall of virus cases, while also controlling emerging inflationary pressures. Looking at the chart of employment changes in the Washington Region to the right, the correlation between the surges in the pandemic and employment growth (think economic growth) is evident. This trend is mirrored in markets across the country and if additional waves of the pandemic emerge, it is likely to persist. As we quoted Dr. Fauci in Q2 2020, “You don’t make the timeline, the virus makes the timeline.”

As more people become vaccinated and the pandemic recedes, the economy should gather steam. If inflation continues to increase, the Fed will be under pressure to accelerate its tapering of asset purchases and/or raise interest rates without derailing the economy. As supply chain issues and labor shortages persist, our concern is whether the Fed will be able to strike the right balance or will we be heading to a period of “stagflation.”

We certainly aren’t economists, but as real estate investors our consideration of these uncertainties shapes the view of how we approach our existing portfolio and what we will look to acquire going forward. With that in mind, in the third quarter we saw the largest level of absorption of apartment units in recent memory, with the District of Columbia leading the way. Rental rates for Class A apartments have risen 10% over the last year – certainly a meaningful increase even when measured against the pandemic depressed levels of 2020. Against this backdrop, we are also hearing anecdotal information of tenants receiving a month plus of free rent as well as reduced rent for renewing in place. While it is hard to ascertain what is going on, the apartment boom continues, fueled both by operating gains as well as insatiable capital markets demand for the asset class.

At the same time, the downtown Washington office market is limping toward a historically high vacancy rate which is projected to exceed 20% over the next couple of years. Why is the apartment market booming while the office market flounders? People are moving into the city in droves. Are they planning on going back to the office? Could this mean the office market is bottoming? While leasing activity has gained some momentum which is encouraging, the nature of much of this activity (shorter term leases, reduced footprints, escalated concession packages, etc.) would suggest that the downtown office market is likely to remain choppy over the near term.

In Northern Virginia, where we have some office exposure, there has been some negative net absorption overall, but predictably, this has mostly taken place in the Class B office market. While this flight to quality dynamic was well underway prior to 2020, the pandemic has clearly accelerated this trend and will deepen the divide between the “haves” and “have-nots” of office assets.

If we are in a flight to quality market, then a tilt towards new development should make sense. We certainly have seen this in the industrial and multifamily sectors over the last couple of years. However, the risk is elevated, especially on certain protracted business plans. With the increasing cost of materials (gypsum board up 30% in 2021, roofing membrane up 25-35%, water heaters up 42% since late 2020 and so on) not to mention delivery uncertainties (steel joists 40-45 weeks, adhesives 12-18 weeks, metal decking 16-25 weeks), the risk of bringing a project in on time and on budget has increased significantly. Adding to that risk is the potential post-pandemic economic surge which could exacerbate supply chain issues and create inflationary pressures going forward.

As the risk and cost of new development rises, existing high-quality assets should compete effectively by providing tenants with functional space and modern amenities at the right price. While new projects will continue to get built, many of which will do well, today’s uncertainties will reward a more balanced risk approach.