The headline of today’s Wall Street Journal read: “Risks of Global Slump Escalate.” This headline is like a lot of other headlines we have all read recently, predicting a more challenging economic future. It is hard to know what to worry about on a given day. One day it’s inflation, the next it’s climate change, then it’s immigration, or maybe our national politics. What about nukes in Russia and China invading Taiwan? By the way, should we still be worried about COVID? It’s no wonder that our mental health is under stress.

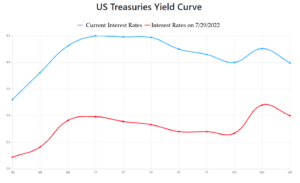

Reflecting all these worries, the markets have experienced what could only be described as a beat down. The roster of YTD returns as of this writing is: S&P 500 -23.2%, S&P US REIT index -26.2%, S&P US Treasury Bond Index -12.41%. The accompanying chart shows the change in Treasury Rates since our last report to investors. In that brief period the two-year treasury has risen 1.6% and the ten-year treasury 1.3% to 4.5% and 4.0% respectively. The Federal Reserve (the “Fed”) has let it be known that fighting inflation is its number one objective, and the markets are feeling the pain of its aggressive rate hikes. This dramatic increase in rates in such a short timeframe is disruptive to almost every real estate transaction in process, and one can only hope that the Fed is on the right course, bringing down inflation and interest rates at the same time. There is no question that this environment will reduce real estate transactional volume in the near term.

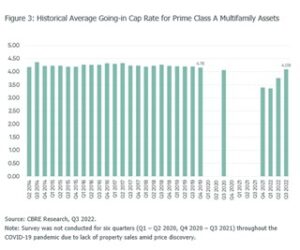

With increasing interest rates, private real estate values will be affected. The question is by how much. What is interesting is that many of the REITs are now trading at 10-20% below NAV, which would signal an over-correction. According to CBRE, cap rates for “Prime A Class Multifamily Assets” have risen by 72 bps over the past two quarters. This implies a value loss of slightly less than 20%, assuming relatively muted rental rate growth. However, according to CBRE, investors are underwriting 3.6% rental rate growth on average over the next three years in this asset class, which would in fact maintain current multifamily asset values.

of the REITs are now trading at 10-20% below NAV, which would signal an over-correction. According to CBRE, cap rates for “Prime A Class Multifamily Assets” have risen by 72 bps over the past two quarters. This implies a value loss of slightly less than 20%, assuming relatively muted rental rate growth. However, according to CBRE, investors are underwriting 3.6% rental rate growth on average over the next three years in this asset class, which would in fact maintain current multifamily asset values.

A point which we have made on previous occasions and a point which is even more evident today is that there are some asset classes (Class A apartments, industrial, life sciences, self-storage, etc.) that continue to have strong occupier demand and low vacancy rates. These asset classes will out-perform because they will increase or hold value in the traditional manner – by increasing net operating income.

To navigate these challenging times, it is important to understand that all real estate is local and cyclical, and that a conservative capital structure is essential to bridge to a more stable environment. In a climate where transaction volume has fallen, we do not necessarily want to be sellers except in the best asset classes. On the other hand, buying opportunities will emerge, and it is often during these times that most interesting acquisitions can be made.