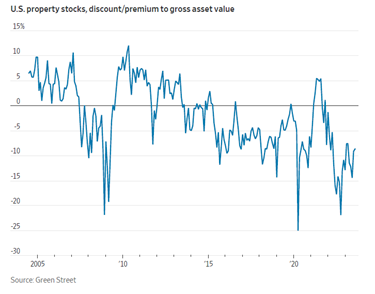

As 2023 began, economic experts were predicting that the economy would slow in the second half of the year and possibly slip into recessionary territory. That certainly has not happened. In fact, the economy seems to be steaming along quite well with the unemployment rate hovering around a historically low 3.8%, and third quarter GDP projections in the 5.1% range. Even though inflation has been reduced to a manageable level (currently 3.7%), inflation anxiety remains, and expectations point to another potential Fed increase in interest rates, which is not good news for real estate values. Economic models show that interest rates will remain relatively high for a longer period, which also is not good news for real estate. These shifts continue to put considerable downward pressure on real estate valuations as reflected in the chart below.

A look at the All Cap REIT index performance for the third quarter shows an 8.2% drop in the value of REIT stocks. We have previously written about the wide bid/ask spread in the private markets and the lack of price discovery and clarity.  REIT performance is a leading indicator and gives a current indication of market expectations.

REIT performance is a leading indicator and gives a current indication of market expectations.

“Publicly traded real estate stocks provide a live read of sentiment toward property markets. In the U.S., listed property companies currently trade at a 10% discount to gross asset values, based on Green Street data. This is a good proxy for the size of the price falls that investors still expect in private real-estate values.” Wall Street Journal

As one might expect, the discount to NAV varies according to property type. For example, the discount on public office stock values is more severe than for industrial REITs. To illustrate the point at the individual company level, Avalon Bay, a highly regarded apartment REIT, is trading at a 6.1% implied cap rate today, has an estimated 5.2% cap rate on its NAV, and is selling individual assets in this market at a sub-5% cap rate. As a result, Avalon Bay’s stock is currently trading at a 17% discount to its NAV. In the office sector, Boston Properties’ stock is trading at an implied cap rate of 8.6% with an estimated 6.8% cap rate on NAV, representing a 27% discount to NAV.

The other factor that has a significant impact on the discount to NAV of REIT stock values is the growth of Funds From Operations (“FFO”). According to Green Street, FFO for industrial REITs is projected to grow by approximately 10% in 2024 and 2025, and by approximately 5% for multifamily REITs; while for office REITs, FFO is projected to be flat over that same time period. In a rising interest rate environment, the only way to grow or hold value is to increase the income generated by a property or portfolio of properties.

The above growth rates align with what we are seeing in our local market. The Washington, D.C. Metro Region has absorbed an impressive 11,000 apartment units over the past 12 months, and apartment rents have increased by 2.2% year-over-year. The industrial markets continue to see positive absorption with limited new supply and rents have grown by 10% over the last year. With increasing new industrial deliveries over the next 12 months, rent growth should moderate but continue to increase at a steady pace. Conversely, office assets continue to struggle with weakened tenant demand and challenging refinancing prospects compromising the leasing prospects of many office buildings. According to Transwestern, absorption for DC was negative for the seventh straight quarter, registering negative 617,000 SF in Q3 2023. Northern Virginia’s performance was mixed, benefiting from the delivery of the 100% pre-leased, owner occupied 850,000 SF Capital One HQ in Tysons. Excluding this pre-leased delivery, Northern Virginia experienced negative absorption of 311,000 SF. When combined with Suburban Maryland’s negative absorption of 213,000 SF, region wide the market gave back well north of one million square feet of office space in the third quarter.

With more sales transactions taking place in multifamily and industrial properties due to strong leasing fundamentals and available capital, price discovery is taking place and solid market footing may not be far behind. As the deep discount to NAV indicates, price discovery on office values is only just beginning. While office is the poster child for distress in today’s market, it is not the only stressed product type out there as higher interest rates and a lack of liquidity in the financing market continue to contribute to a rise in troubled properties. Banks, not eager to foreclose and own properties, are pushing owners to sell, and we are seeing asking prices reach deeply distressed levels. The pressure is building, and distressed selling will increase over the next twelve months as the cycle begins to bottom. Good buying opportunities will emerge for those groups with cash, an entrepreneurial vision, and access to creative financing approaches while owners of non-distressed properties should remember: “Stay alive ‘til ’25!”