In the third quarter, markets cheered the Fed’s much-anticipated cut in the Federal Funds Rate. As the Fed had signaled a rate cut for its September meeting, the only question that remained was whether it would be 25 or 50 bps? The Fed chose the latter and then signaled its intent to make additional cuts by year-end, exhibiting its comfort with the current course of inflation. The S&P 500 responded strongly to the rate reduction, rising by over 4% in the three weeks since the announcement and bringing this year’s gain to a whopping 23%.

While rates remain high when compared to historical levels, there is also a sense that this is a move towards normalization. The question is what does normal look like. For the 40 years prior to 2007, the yield on 10-year Treasuries never fell below 4%. With 10-year Treasuries hovering just above 4% now, perhaps the old normal will be the new normal.

At the same time, spreads tightened in the third quarter. The markets have climbed the wall of worry and may be entering a period of FOMO (fear of missing out). Whatever term is used, the perceived level of risk has lessened as the economy chugs along and rates begin to fall.

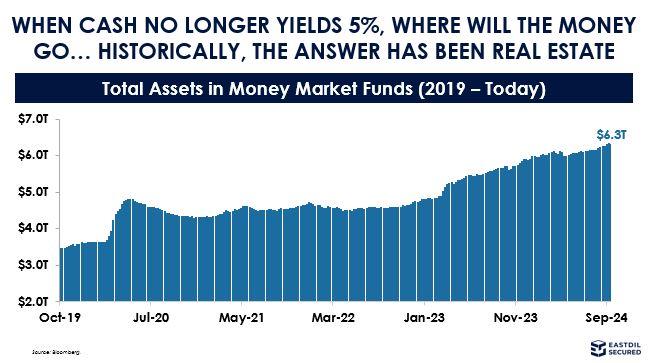

One result of the higher interest rate market which we have been experiencing is the wave of money that has poured into money market funds.  It started with the pandemic as risk-adverse investors sought to increase liquidity and rose again with the higher returns offered as the rate of inflation increased. “…but the assumption that the owners of this capital are simply content to T-Bill and Chill, earning 2.0% – 3.0% in a money-market account is short-sighted.” – Eastdil Secured – Capital Markets Update September 27, 2024

It started with the pandemic as risk-adverse investors sought to increase liquidity and rose again with the higher returns offered as the rate of inflation increased. “…but the assumption that the owners of this capital are simply content to T-Bill and Chill, earning 2.0% – 3.0% in a money-market account is short-sighted.” – Eastdil Secured – Capital Markets Update September 27, 2024

Capital moves quickly in today’s world and with $6.3 trillion in money market funds, small moves can make a significant difference. As the markets get comfortable with the direction of inflation and interest rates, investors may turn their attention away from declining money market yields and towards higher yielding asset classes such as cash flowing real estate investments.

We started writing about the real estate market bottoming in the first quarter of 2024. In the third quarter, office led the way for REIT stocks, rising 23.9%. While this is certainly a bounce off the bottom, and another sign of recovery, the underlying fundamentals still feel grim in the office sector in the Washington Region. While there are more property sale transactions taking place, these sales are generally lender forced and tend to trade well below the debt level. Buyers recognize that these assets will require significant capital to reposition and lease, and, as a result, they are highly focused on their basis upon “re-stabilization” of the property. The major risk that these new buyers face is the ability and cost of leasing space in a higher vacancy, lower velocity marketplace. While these investors do have a leasing advantage due to their right-sized basis and revised capital structure, it is likely that future new owners will soon share this same advantage as the pace of sale and recapitalization transactions accelerates in the next year.

The office leasing statistics for the third quarter were dismal in both DC and Northern Virginia. According to Cushman Wakefield, in DC “eight out of the top ten deals in Q3 were contractions with the average tenant downsizing by 36% of the original space.” The vacancy rate in DC stood at 21% at the end of the quarter, the highest in recent memory. In Northern Virginia “overall average vacancy rates rose by 200 basis points year-over-year to 24.1% an 80-bps increase from Q2.” Despite negative net absorption of space in both markets, overall leasing volume is up, indicating that tenants are beginning to have a clearer picture of what hybrid schedules look like. As job growth around the region remains positive and additional office buildings are slated for redevelopment, there is also a growing sense that this tenants’ market won’t last forever.

Now, let’s look at the region’s dramatically different multifamily market which is outperforming most of the country. Like the office sector, there have been foreclosures and bank sales of multifamily assets that can’t be refinanced at higher rates or are simply worth less than the debt they carry. However, in the last twelve months rents have risen 3.3% in DC and 5.1% in Northern Virginia and absorption has remained robust with the region absorbing 15,000 units, which is close to 3,500 units more than the historical average. Much of the new multifamily construction is in the District of Columbia as is much of the absorption. With unit absorption keeping pace with supply, and interest rates falling, owners have more options than their office building counterparts, lenders are more patient with existing borrowers and new debt capital is available.

While many local people worry about the health of the Washington DC market due to the crippled office market, a slow return to work stance by the Government, and the effect of fewer people downtown (namely a struggling retail universe and increasing crime), it is ironic that the apartment demand is so robust. Despite its problems, the region continues to prosper, generating 36,000 new jobs YOY, and attracting people from all over the world to this dynamic city which has proven to be a much in-demand place to live, play and work.